- REAL TIME CURATION

- of financial feeds, Wall Street research, communities, and social media -

- by traders for traders;

- MARKET COMMENTARY:

- Real time alerts on important factors which will affect or are affecting the market including technical factors and floor imbalances;

- ACTIONABLE CONTEXT:

- If applicable, within seconds and minutes, utilizing our real time database of accumulated Wall Street research;

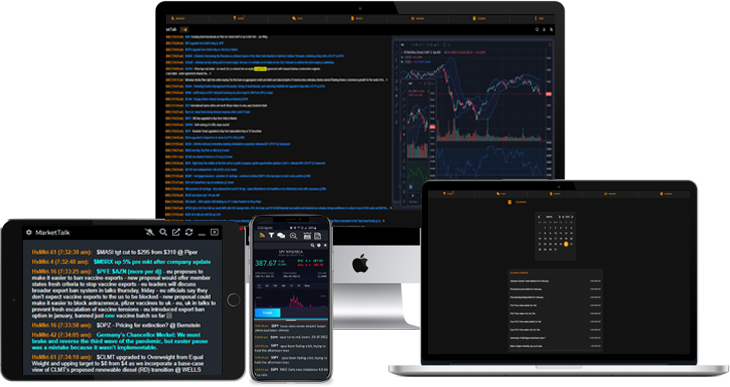

Our Platforms

Live News Feed and Forum

Get all the latest breaking stock market news, up to the minute market commentary, curated and filtered to ensure you get the most relevant stock news. We filter out the noise and provide you with real actionable context. Including:

- Real-Time Breaking News With Trader Context

- Actionable Ideas & Running Commentary

- Over 1,600 Real-Time News Updates Per Day

- Earning Releases & Interpretation

- Proprietary Research

- Custom Filters & Emailed Alerts

- Convenient Mobile App w/ Alerts

- Live, News & Chat Forum For Retail Traders

- 100% FINRA Compliant For Institutional Traders

4x Daily Market Reports

Hammerstone Reports are expertly written daily updates sent 4 times per day directly to your inbox. These reports give you an in-depth analysis of earnings reports, street recommendations, economic data, sector news, market movers and more.

- Early Look - Pre-Stock Market Opening

- Street Recommendations - What Wall Street Analysts Are Saying Pre-Market

- Mid-Morning Look - Midday Trading

- Closing Recap - End Of Day Market Changes And Sector New Breakdowns

Get Started Today!

While They're Still Waiting For The Latest Stock Market News, You Could Have Already Executed The Trade... Get Started With Hammerstone Markets Today!

No obligations, no contracts. Cancel at any time, 100% risk free.

Institutional Trader

Hammerstone’s Institutional News Feed And Forum$299 - $329/mo*

*Plus applicable taxes- 100% FINRA Compliant Chat Room And News Feed, Designed For Professional Traders With Full Compliance Requirements Embedded.

Individual Trader

Designed for individual Trader$39 - $69/mo*

*Plus applicable taxes- Real-Time News Feed and Nasdaq Quotes

- Hammerstone’s TradeDirect™, and

- Hammerstone’s MarketTalk™ Chat Forum. and

- Easy Look-up Street Research

Corporate Affiliations

Testimonials

Here's a Sample Feed from MarketTalk™, Our Individual Trader's Platform

Please Note: The Below Is 1 hour and 30 minutes Of Morning Content Condensed To A 30 Second Example (Without Chat Room).